May 2025

Closing the Books: Managing Final Accounts in JCT and NEC Contracts

By Claire King and Katherine Butler

Whether it is called the “final account” or “final assessment”, managing the final account process effectively can be the difference between making a profit or a loss on a contract for a Contractor. For an Employer, it can be the difference between paying what is properly due or allowing (arguably) unsubstantiated claims to slip through the net.

In this Insight we compare and contrast the “final account” processes under the JCT and NEC41 forms of contract and analyse how to get the best result you can from these processes.2

What do we mean by the “Final Account”?

The exact definition of the “final account” will depend on what it is defined as (or not defined as) in any given contract. However, broadly, the final account means the final determination of what monies are due under the contract at the end of the defects period provided for (excluding any latent defects). The final account should be contrasted with interim payments which can be adjusted as required. As stated by Hobhouse J in Secretary of State for Transport v Birse-Farr Joint Venture3:

“Certification may be a complex exercise involving an exercise of judgment and an investigation and assessment of potentially complex and voluminous material. An assessment by an engineer of the appropriate interim payment may have a margin of error either way. It may be subsequently established that it was too generous to the contractor just as it may subsequently be established that the contractor was entitled to more…. At the interim stage it cannot always be a wholly exact science. Its purpose is not to produce a final determination of the remuneration to which the contractor is entitled but is to provide a fair system of monthly progress payments to be made to the contractor” [emphasis added].

Given the ‘finality’ of the final account (and any payment or repayment associated with it), it is obviously important to get the best out of the process. With that in mind, we set out the detailed rules found in the JCT and NEC contracts below, before examining our “top tips” for both processes.

JCT and the Final Account

From a UK perspective, the JCT is still the most popular standard form for certain types of projects, albeit the NEC form is catching up rapidly. As such the final account processes should already be familiar. However, it is surprisingly common for those operating these contracts to fall into the potential traps in the JCT, particularly if they are ill-prepared.

Process and Timings

Regarding the 2024 editions of the most commonly used JCT forms, the Design and Build Contract and the Standard Building Contract, there are some nuanced differences in the final account processes under these two forms.

Starting with the JCT Design and Build, clause 4.24.1 states:

“Following practical completion of the Works the Contractor shall submit the Final Statement to the Employer and supply such supporting documents as the Employer may reasonably require”.

Providing “such supporting documents as the Employer may reasonably require” is a fairly vague requirement. However, a good rule of thumb is for the Contractor to provide as many supporting documents as possible.

Clause 4.24.2 details the main definition of the Final Statement, noting that it is a document setting out the adjustments to the Contract Sum, what the post adjustment Contract Sum equates to, and the amounts that have previously been paid to the Contractor. Overall, the Final Statement details the ultimate amount due to the contractor, or, indeed, if sums are due from the Contractor to the Employer. Within the Final Statement, the Contractor also needs to set out the basis on which the balance of sums due was calculated, including any and all adjustments to the Contract Sum.

Clause 4.24.3 goes on to deal with timings. With the Design and Build form, the onus is on the Contractor to issue the Final Statement withing three months after Practical Completion (“PC”). This is relatively soon, and it may well be that the ultimate balance due cannot be known at this point. At this stage, the Final Statement is the Contractor’s “opening position” and it will be an iterative process to prepare the final final account prior to the due date for final payment. In circumstances where the Contractor does not provide the Final Statement within three months, the Employer can give a two month notice to comply. If there is still no Final Statement, the Employer can then issue its own. This will then be the document to be discussed, updated and negotiated until the due date for final payment.

The position under the Standard Building Contract, at clause 4.25, is somewhat different. Here, the contract refers to a Final Certificate rather than a Final Statement. Unlike under the Design and Build, the Contractor is not responsible for preparing the Final Certificate. Instead, it provides “all the documents necessary for the Contract Administrator or QS to make all the necessary adjustments to the Contract Sum". After six months following PC, the Contract Administrator will issue a statement of the sums due, either to the Contractor or, potentially, to the Employer.

Under the Standard Building Contract, the role of the Contract Administrator is much more active in terms of determining the final account. This is compared to the Design and Build position where the Employer’s role is to verify the Contractor’s view of what the account should be. Clause 4.25.3 notes that where the Contractor fails to provide the necessary information regarding the adjustments to the Contract Sum, the Contract Administrator is empowered to make their own assessment.

Whether you are operating the Design and Build or the Standard Building Contracts, the final account processes are both building up to the due date for final payment.

Clause 4.24.5 of the Design and Build form states that the “due date for final payment is one month after whichever of the following occurs last:

- The end of the Rectification Period;

- The date in the Notice of Completion of Making Good; or

- The date of the submission of the Final Statement or Employer’s Final Statement”.

On the basis of the default position under the JCT, the latest of these is likely to be end of the Rectification Period (i.e. six months after PC). The date in the Notice of Completion of Making Good may be later but, if there are no defects notified as needing to be remedied, there is no obligation for such a notice to be issued.

With the Standard Building Contract, the timeframes are slightly different. Under clause 4.26, a Final Certificate shall be issued no later than two months after the latest happening of the same events (so, one month longer). Further to which, the due date for the final payment is the last day of the two month deadline for the issue of the Final Certificate. As a worked example, if the Rectification Period ends on 30 April, the Final Certificate may be issued up to 30 June (but could be issued sooner) and the due date for final payment will be 30 June.

Calculating the due date for final payment is important as it relates to when the Contractor will be paid the final amount due, or the Employer being repaid by the Contractor as the case may be, as well as the timings for any Pay Less Notices. It is also important regarding the Effect of the Final Statement or Final Certificate, which will be covered later in this Insight.

Adjustments to the Contract Sum

Any Final Statement or Final Certificate will involve an evaluation of how and to what extent the Contract Sum is to be adjusted. Readers will note that the Contract Sum can only be adjusted in line with the terms of the Contract; therefore, any errors in the original Contract Sum are deemed to be accepted.

The list below sets out the contractual ways in which the Contract Sum can be adjusted, some of which are more commonly engaged than others (for instance, variations will happen on most projects but provisions allowing adjustments on the basis of price fluctuations are usually deleted):

- Sums due under the Valuation Rules;

- The value of Changes / Variations;

- Acceleration Costs;

- Fluctuations (if applicable);

- Deduction of Provisional Sums;

- Omissions (if permitted);

- Loss and Expense;

- Insurance Premiums;

- Unnecessary ‘Opening Up’;

- Costs reasonably incurred for exercising the right to suspend for non-payment; and

- LESS deductions (e.g. defects not rectified, etc.).

The JCT is not as prescriptive as other standard forms as to how any adjustments to the Contract Sum are evidenced. However, and as stated above, the more records to substantiate its costs that the Contractor can provide, the better. Such records can include invoices for scaffolding that is needed for longer due to Employer delays or signed and dated timesheets for designers where a change to the Employer’s Requirements has been instructed, as just two examples. The main point to take away for Contractors is that it is vital to maintain contemporaneous records of these costs. This is so that, again by way of example, variations can be properly valued or that daily/weekly run rates for loss and expense can be ascertained. The importance of these records and keeping paperwork in good order cannot be overstated.

The effect of the Final Statement / Final Certificate

There is a very important, but often overlooked, aspect of certain JCT contracts regarding the effect of the Final Statement or Certificate. Unlike other standard forms, such as the NEC or FIDIC, the JCT does not generally include time bar provisions. For example, unless amended, the JCT does not require a Contractor to issue a delay notice within a specified time, or else lose its entitlement to any EOT or loss and expense. That said, the major JCT forms do include a time bar when it comes to the effect of the Final Certificate or Statement.4

Under clause 1.8.1 of the Design and Build Contract, at the point of the due date for final payment, the Final Statement becomes conclusive evidence that:

- the quality of any materials or goods or any particular standard of an item of workmanship (as per the Employer’s Requirements or instruction etc) was to the Employer’s reasonable satisfaction;5

- all extensions of time have been given; and

- all direct loss and or expense that is due to the Contractor has been agreed, ascertained or valued.

The aim of this provision is to make the Final Statement both final and binding. However, clause 1.8.2 goes on to state that the effect of the Final Statement shall be suspended where one party commences an adjudication, arbitration or other proceedings within 28 days of the due date for final payment. This means that if one party disputes an aspect of the Final Statement but does not commence a dispute resolution process within that timeframe, that party will be taken to accept it and will lose its chance to challenge it at a later date. This is serious consequence and 28 days is a very tight deadline.

The same provision is largely mirrored in the Standard Building Contract, at clause 1.9. However, one major difference is that the elements of the Final Certificate which will be become conclusive are expanded to include “all necessary adjustments to the Contract Sum”.6 This means that the Final Certificate is conclusive evidence of pretty much the entire account. The Final Certificate sum becoming final and binding can only be avoided if it is formally challenged within 28 days of the due date for final payment. This is why it is very important to understand the various contractual timeframes detailed above.

Conclusive evidence

In terms of how the “conclusive evidence” provisions have been applied in practice, there is useful guidance to be found in the case law.

In the case of the Trustees of the Marc Gilbard 2009 Settlement Trust v OD Developments and Projects Ltd,7 the judge upheld the clause 1.9 time bar under a Standard Building Contract. Further, the judge confirmed that all elements of the Final Certificate that are not agreed must referred to dispute resolution before the deadline. Any matters not included in that dispute will be taken to be accepted and will become conclusive evidence of the sums due. As a result, it is important to ensure that any claim form, arbitration notice or adjudication notice is drafted as broadly as possible.

In the 2022 Scottish case of D McLaughlin & Sons Ltd v East Ayrshire Council,8 the contract had been amended to require that any disputed adjudicator’s decision concerning the Final Certificate had to be referred to litigation within 28 days of that decision. The Employer did not like the adjudicator’s decision but was held to be out of time as it waited 72 days to formally challenge the award. The lesson here is to be on the lookout for contractual amendments which create additional time bars as these will be strictly enforced.

As outlined above, the JCT time bars will be upheld. As such, it is important to understand how to avoid the Final Certificate or Statement becoming conclusive. To that end, what does “commencing proceedings” mean?

In Bennett v FMK Construction Limited,9 the judge held that the requirement to commence proceedings had been satisfied when a valid Notice of Intention to Refer a Dispute to Adjudication was issued within the 28 day period. This was the case even though no Referral Notice was issued within the prescribed 7 days thereafter.

This decision was supported in the case of University of Brighton v Dovehouse Interiors Limited.10 In her judgment, Mrs Justice Carr (as she then was) considered that the position was akin to facing the expiry of a limitation period. In that circumstance, issuing a Claim Form or Notice of Arbitration is sufficient to “stop the clock” and the same rationale should be applied here.

It is, however, worth remembering that commencing proceedings only “suspends” the Final Statement or Certificate becoming conclusive. Clause 1.8.3 of the Design and Build Contract and clause 1.9.3 of the Standard Building Contract state:

“any proceedings shall be treated as concluded if during any period of twelve months commencing on or after the issue of the [Final Statement / Certificate] neither Party takes a further step in them”.

Accordingly, it is not possible to put an indefinite “hold” on the Final Statement or Certificate becoming conclusive by simply issuing an Adjudication Notice or a Claim Form. Further action will need to be taken to conclude any dispute within 12 months.

Commencing proceedings – exception

There is, however, an exception to the “commencing proceedings” requirement under the JCT Design and Build Contract.

Clause 4.24.6 of the Design and Build Contract states:

“Except to the extent that prior to the due date for the final payment the Employer gives notice to the Contractor disputing anything in the Final Statement or the Contractor gives notice to the Employer disputing anything in the Employer’s Final Statement, and subject to clause 1.8.2, the relevant statement shall upon the due date become conclusive as to the sum due under clause 4.24.2 and have the further effect as stated in clause 1.8”.

To summarise, this provision states that clause 1.8 (regarding the conclusive effect of the Final Statement) operates as normal unless either party gives notice that it disputes anything in the Final Statement prior to the due date for final payment. Unlike the need to commence proceedings under clause 1.8.2 (which must happen within 28 days after due date for final payment), this notice must be given between the issue of the Final Statement and the due date for final payment.

What this clause means in practice was considered in the decision in CC Construction Limited v Raffaele Mincione.11 In this case, the Contractor issued a Final Statement on 1 December 2020. This started the clock for the calculation of the due date for final payment (which was 28 December 2020). On 18 December 2020, the Employer sent the Contractor a letter saying that it disputed the Final Statement. Further to which, the Employer did not take any further steps in terms of commencing any formal dispute resolution proceedings.

At trial, the Contractor argued that the Final Statement had become conclusive evidence of the sums due. This was because the 18 December letter, on its own, was not sufficient to avoid the clause 1.8 time bar and that the Employer also needed to commence timely proceedings. The judge disagreed. It was held that the letter was sufficient on the basis that the requirements under clause 4.24.6, as against clause 1.8, were “different rather than cumulative”. This meant that the Employer could either give notice or commence proceedings, it did not need to do both.

This is not an option under the Standard Building Contract as there is no provision similar to the Design and Build form clause 4.24.6. Therefore, under the Standard Building Contract, a party cannot challenge the Final Statement simply by issuing a letter saying that it is disputed. It will require proceedings (such as an adjudication) to be started within the specified timeframes.

The NEC4’s Final Account process

The NEC ethos and approach is very different to that of the JCT contracts and emphasises “pro-active risk management of risk and change”.12 The idea is that a prospective evaluation of risks occurring will mean that the parties can move on and avoid the classic final account dispute. Indeed, the NEC3 did not even contain a final account process, and it was only added in June 2017 when NEC4 was published. Even then, its addition was somewhat reluctant with the NEC4 Guide noting that:

“The Parties should of course have been building up to this point and very little should need to be done to close the account.”

Whether this is the reality or not will of course vary from project to project, but the very addition of clause 53 suggests that a final account process was considered to be helpful.

Clause 53

So what does clause 53 [Final Assessment] provide for? Clause 53.1 states:

“The Project Manager makes an assessment of the final amount due and certifies a final payment, if any is due, no later than

- Four weeks after the Supervisor issues the Defects Certificate or

- Thirteen weeks after the Project Manager issues a termination certificate

The Project Manager gives the Contractor details of how the amount due has been assessed. The final payment is made within three weeks of the assessment or, if a different period is stated in the Contract Data, within the period stated”.

In normal circumstances, the Contractor should be aware of (roughly) when the Defects Certificate will be issued and is therefore able to anticipate when the clock for the final assessment will start running. As such, it is sensible to anticipate this by ensuring the necessary information for the final assessment has already been submitted as part of the interim application process13 and/or generally. This will mean the Project Manager knows what the Contractor’s position is (and has the relevant supporting evidence and records) in advance. This is particularly important if the gap between the parties is potentially wide as four weeks is not a lengthy time for an assessment.

If there has been a termination (whether for fault or for convenience) a period of 13 weeks is provided for the assessment. However, this is still not a lengthy time period and, as such, the Contractor should consider how quickly they can compile as many relevant records to support their position as possible.

Keating on NEC (Second Edition) notes that: “It is suggested that parties ought to consider amending the contract so as to clarify whether the Contractor is obliged to make an application for payment for the final amount due, the basis on which the final amount due is calculated, whether there is an assessment date, and, if so, when”.

In our view, that is unnecessary most of the time – especially where an application was made just before the Defects Date in any event – but it is worth checking that you have provided everything you can to justify your position in advance of the deadline. The key issue is always whether the Project Manager has the records available to make the assessment you want them to as the Contractor.

What happens if the Project Manager forgets?

If this happens, clause 53.2 applies and allows the Contractor to issue their own assessment.14 It seems likely that this would make the Project Manager unpopular with the Client so again, anticipation is key.

This is particularly important because once a final assessment has been served by either the Project Manager or (if applicable) the Contractor, there is a limited period to dispute the assessment before it becomes “conclusive evidence” of what is due.

Clause 53.3 provides that the assessment becomes “conclusive evidence of the final amount due under or in connection with the contract unless a Party” takes specific actions depending on which Dispute Resolution Option applies (W1, 2 or 3). In broad terms, the dispute must be notified within 4 weeks and referred to dispute resolution.

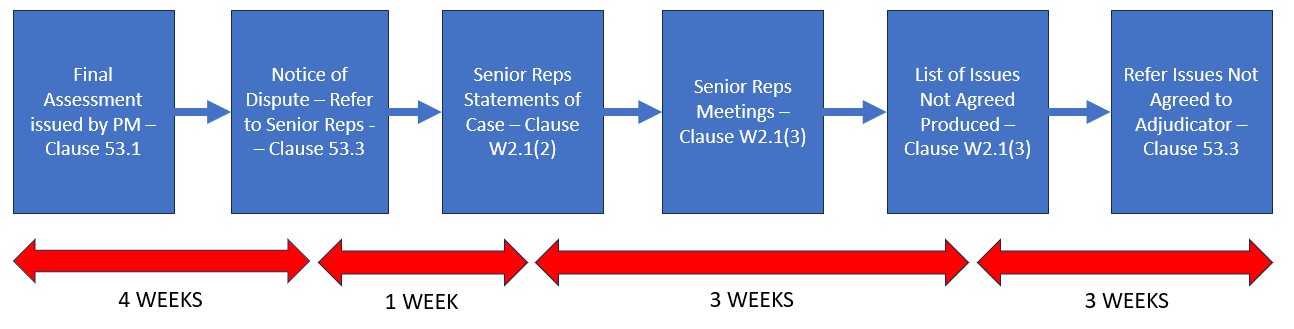

A timeline summarising the steps required under Option W2 (where the Housing Grants, Construction and Regeneration Act 1996 (the “Act”) applies) is shown below:

The key point to note is that, as outlined in the JCT case law, these provisions will be enforced under English law. As such it is critical that a Notice of Dispute is served in time.

Option W2 and the Final Account

Under Option W2 (which is the most common Dispute Resolution Option for domestic projects), a referral must be made to Senior Representatives or to adjudication (which can be “at any time” pursuant to the Act) within four weeks.

Senior Representatives process

Unless there is a specific reason to start an adjudication, then the Senior Representatives process can often be productive and lead to the reduction of issues in dispute, if not final settlement. However, preparation is (as ever) key to get the best out of the process. Key issues to think about include:

- Have you checked you have complied with the notice provisions within the Contract when referring to the Senior Representatives process? Obviously, this is particularly critical if the referral is made at the last minute. If not, you may be time barred.

- Do you have Senior Representatives appointed? Does the other side have Senior Representatives appointed? It is important to ensure that the names have been updated if key people have left during the course of the project.

- Are your Senior Representatives available in the required time period? Only three weeks are provided for the meetings and big disputes may require a significant time commitment in order to get a decent result.

- What is the focus of your statement of case (Option W2.1 (3))? This needs to be focussed and to the point. You are only allowed 10 sides of A4.15 If in doubt, the old adage “follow the money” is a helpful one.

- The aim of the Senior Representative process is to produce a “list of the issues agreed and issues not agreed” (the “List of Issues”). It is therefore important to ensure that the matters to be discussed / decided by the Senior Representatives is comprehensive. The List of Issues is what will end up being your agenda for an adjudication depending on what is agreed or not agreed at the end of the process. It is therefore vital that no issues that are in dispute are left off.

- Brief your Senior Representatives properly. Senior Representatives are meant to be able to stand above the politics or personality clashes that too often become problematic in disputes. However, they need to know your position (including its weaknesses) to negotiate properly. Time therefore needs to be set aside to brief them.

- Is it worth agreeing an EOT with the other side for the whole process OR is the timetable helpful to keep the pressure on? The timetable is a tight one. This can be useful to focus minds but if progress is being made more time may be required. If this can be thought about in advance of the deadline that is always helpful.

- Make sure the ultimate List of Issues makes sense and covered everything. This is crucial for any adjudication as that is the next step if a resolution is not reached.

After the List of Issues is finalised at the end of the Senior Representatives process, there is a three week period issue to commence an adjudication or the final assessment becomes binding on the parties.16

Adjudication

As a result of the three-week deadline for an adjudication, it is important to think about and anticipate this step as much as possible in advance of the List of Issues becoming finalised. For example, consider whether it would be helpful to get expert evidence prepared, if it has not been already, as well as whether witness statements need to be taken. The key point is obviously to anticipate.

Finally, if even adjudication does not resolve the issues, then the next steps is either arbitration or the Court. Either way, you also need to ensure that any Notice of Dissatisfaction is served in time after the Adjudication Decision.17

Top Tips

With our guidance on the specific forms in mind, there are common themes for ensuring the success of your final account under whichever contract you are using. These are summarised below:

- Records, records, records!

The calculation of the ultimate sums due will need to be evidenced. Make sure that you keep good records of the costs incurred. Wherever possible, these should be contemporaneous documents proving that monies or time have been spent that you are entitled to be paid for. Systems for retaining and organising these records should be set up at the outset of the project, rather than an afterthought.

- Check the contract

The contract will detail how the final account is going to be calculated (i.e. through valuation rules and/or how costs incurred are to be evidenced). The contract will also be likely to detail strict deadlines and timeframes for the completion of the final account process. Knowing what the contract requires will ensure that you are not caught out.

- Start early

Linked to points 1 and 2 above, do not wait until the end of the project to start your preparations for the final account. Keeping up to date with your record keeping and diarising deadlines will help you to maximise your return and ensure that all your rights are preserved.

- Open lines of communication

As between Employers, Contractors, Contract Administrators and project Quantity Surveyors, projects are much less likely to end up in dispute if there is open and honest communication. Resist the urge to “raise the drawbridge” when the potentially contentious subject of the final account comes up.

- Plan out the contractual timeframes

It may sound simple, but putting markers in your calendar can be incredibly helpful. Once certain project milestones pass (such as achieving PC), check the contract and plan out the various timeframes and/or deadlines that flow from it.

- Be ready to start proceedings

Given the potentially tight deadlines included in your contract to challenge a final account that you do not agree with, make sure you are ready to start proceedings. This may involve considering if you are going to need expert input (i.e. on quantum, delay, defects) and retain these experts early. If you wait until the deadline to start proceedings is approaching, it may already be too late to submit quality evidence and/or submissions.

In summary, planning for your final account process will put you in a good position to get the most from your contract and avoid costly disputes. Anticipation is key.

- 1. Focussing on the Engineering and Construction Contract for the purposes of this Insight.

- 2. A webinar on this topic can also be viewed at https://www.fenwickelliott.com/research-insight/webinars-podcasts/closing-the-books-managing-final-accounts-in-jct-and-nec-contracts [1].

- 3. (1993) 62 B.L.R. 45.

- 4. Time bar provisions regarding the final account are included in the Design and Build, the Standard, the Intermediate, the Management and the Prime Cost contracts. They are not included in the less commonly used JCT contracts such as the Minor Works, Major Projects, PCSA or the Constructing Excellence contracts.

- 5. But not conclusive evidence that they or any other materials, goods or workmanship comply with any other requirement or term of the contract.

- 6. Save where there has been an erroneous inclusion or exclusion of any work, materials, goods or figure or an arithmetic error.

- 7. [2015] EWHC 70 (TCC).

- 8. [2022] CSIH 42.

- 9. [2005] EWHC 1268 (TCC).

- 10. [2014] EWHC 940 (TCC).

- 11. [2021] EWHC 2502 (TCC).

- 12. See the Preface by Peter Higgins to the NEC4 Edition of the ECC.

- 13. Pursuant to clause 50.1 the assessment dates continue until the Defects Date or the date a termination certificate is issued.

- 14. Clause 53.2 provides that: “If the Project Manager does not make this assessment within the time allowed, the Contractor may issue to the Client an assessment of the final amount due, giving details of how the final amount due has been assessed. If the Client agrees with this assessment, a final payment is made within three weeks of the assessment or, if a different period is stated in the Contract Data, within the period stated”.

- 15. See clause W2.1 (2).

- 16. See clause 53.3.

- 17. See Claire King’s blog on this topic at https://www.fenwickelliott.com/blog/dispute-resolution/notices-dissatisfaction-nec [2].